Advice For Surviving The Banking Crisis.

[photo by Mart Production via Pexels.com]

The recent failures of Silvergate, SVB (Silicon Valley Bank), and Signature Bank, plus the near-failures of First Republic and Credit Suisse came as no surprise to those of us who have been paying attention for the past few years. The global economic system is nothing but a gigantic Ponzi scheme built on a foundation of delusions. Its collapse isn't just possible; it's actually inevitable. Financial experts such as Robert Kiyosaki were warning us in 2020 that the dollar would soon be worthless and we should move our money out of the banks. Most people didn't listen.

The Federal Reserve and other central banks have launched various damage control methods to try and prevent a contagion of bank runs and so far the general public has remained calm. But the recent bank failures have exposed how fragile the system is, and bank regulators are worried the slightest spark could ignite a panic that will bring down dozens if not hundreds of banks around the world. There's really no more time to waste to protect your money. History has shown us that the regulators will impose a "bank holiday" without warning if they suspect a major bank run is about to happen. If that happens, bank branches will be closed, online banking will be down, and ATM's won't work. You won't even be able to get your valuables out of your safe deposit boxes until the bank regulators let you back in, and that could take days, weeks, or even months if the situation is dire enough.

So what can you do to prepare? First let me make clear that I'm offering "security advice", not "investment advice". And so the first thing you need to do is to choose a stable, well-managed bank. Find a bank with a conservative management style. You want a banker who runs a tight operation and puts the safety of the depositor's first and foremost. You want this guy:

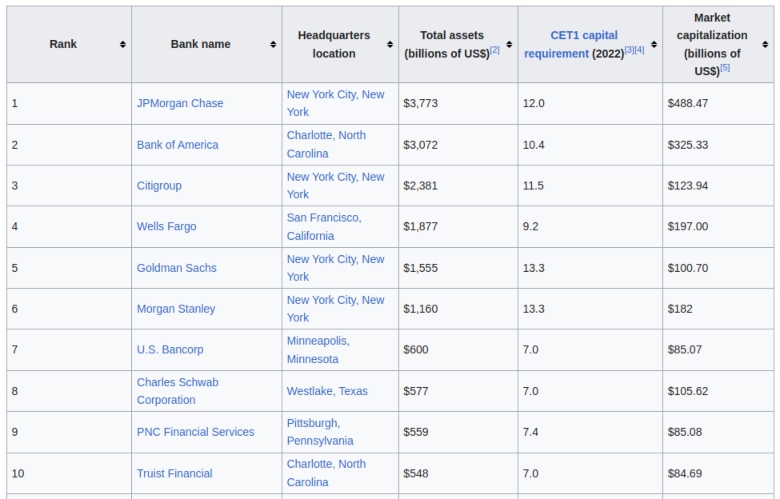

Avoid banks that put ESG (environmental, social, and governance) scores and DEI (diversity, equity, inclusion) goals ahead of good banking practices. When you go woke, you go broke. Also avoid the world's largest banks. Those are the ones that are working with the government to introduce CBDC's (central bank digital currencies) to replace our current financial system. You can learn about CBDC's in this post I uploaded in January.

Here is a chart showing the ten largest banks in the United States:

[source: Wikipedia.org]

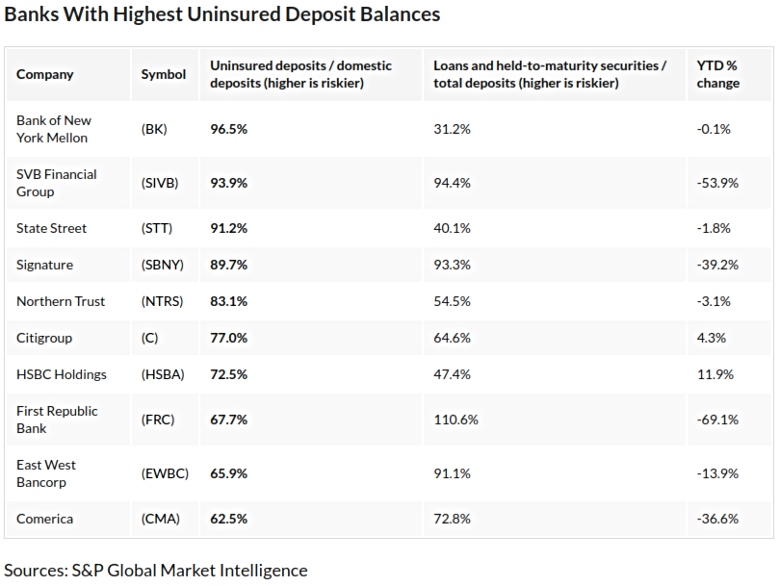

Financial expert Catherine Austin Fitts recommends you avoid banks that have a high percentage of uninsured deposits. These are deposits in excess of FDIC limits. The higher a bank's uninsured deposits, the higher their exposure to risk. SVB failed, in part, due to their very high percentage of uninsured deposits.

Here is a chart showing the big banks with the highest uninsured deposit balances. And below it is a graph showing the same information but for the smaller, regional banks.

[source: Investors.com / S&P Global Market Intelligence]

[source: Investopedia.com]

Banking local with people you know is always a smart choice. The Solari Report wrote an article explaining exactly how to do that. I strongly suggest you read it:

CHD-TV's weekly show "Financial Rebellion" with Catherine Austin Fitts and Carolyn Betts recently had a discussion about the SVB failure and how we can protect ourselves by banking locally. I've linked to the video below:

Financial Rebellion on Children's Health Defense TV:

SVB Fallout + Who's Your Banker? March 16, 2023

Once you've gotten your bank sorted out, I suggest you keep a minimum amount on deposit. While the FDIC says they guarantee deposits up to $250,000, the agency doesn't have enough money on hand to protect every depositor in the event of a nationwide bank run. The Fed broke its own rules in the case of SVB and guaranteed all deposits, but Fed Chair Janet Yellen has already stated that they won't be doing that for every bank in the next crisis. There will be winners, and there will be losers. Make sure you're on the right side.

Keep cash on hand in your home or office, securely protected by fire-proof safes and alarm systems. Buy gold and silver. Buy guns and ammo and know how to use them. Additionally, ammo can be as good as cash during a collapsing economy. The same applies to food, first aid supplies, tools, and even liquor. Vodka has many uses beyond getting you drunk, and is a very tradeable commodity during a crisis. These are all things you can use as forms of currency if wake up one day and find none of your credit or debit cards are working and angry mobs are attacking the (closed) banks. And having a few months of food on hand will dramatically cut down your anxiety level when everyone else is losing their mind. Keeping your car's fuel tank full all the time is also wise.

And there you have it. Follow these fairly easy steps and help protect your finances from incompetent and corrupt bankers and the social unrest that will no doubt come after the next round of bank failures.